Compliance Q&A: Reporting Prescription Drug and Health Care Spending

Question

What steps do plan sponsors need to take to comply with the Prescription Drug and Health Care Spending Requirements? How do these rules fit into the larger picture of recent healthcare transparency laws?

Summary

The Consolidated Appropriations Act (CAA) of 2021 includes many benefit and tax provisions affecting group health plans.1 Section 204 of the CAA requires plan sponsors to submit general information annually regarding the plan or coverage, as well as detailed information surrounding prescription spending, total health care spending, and the impact of any prescription drug rebates, fees, or other compensation affecting premiums and out- of-pocket costs. This information is required in the form of a Prescription Drug and Health Care Spending ("RxDC") report.

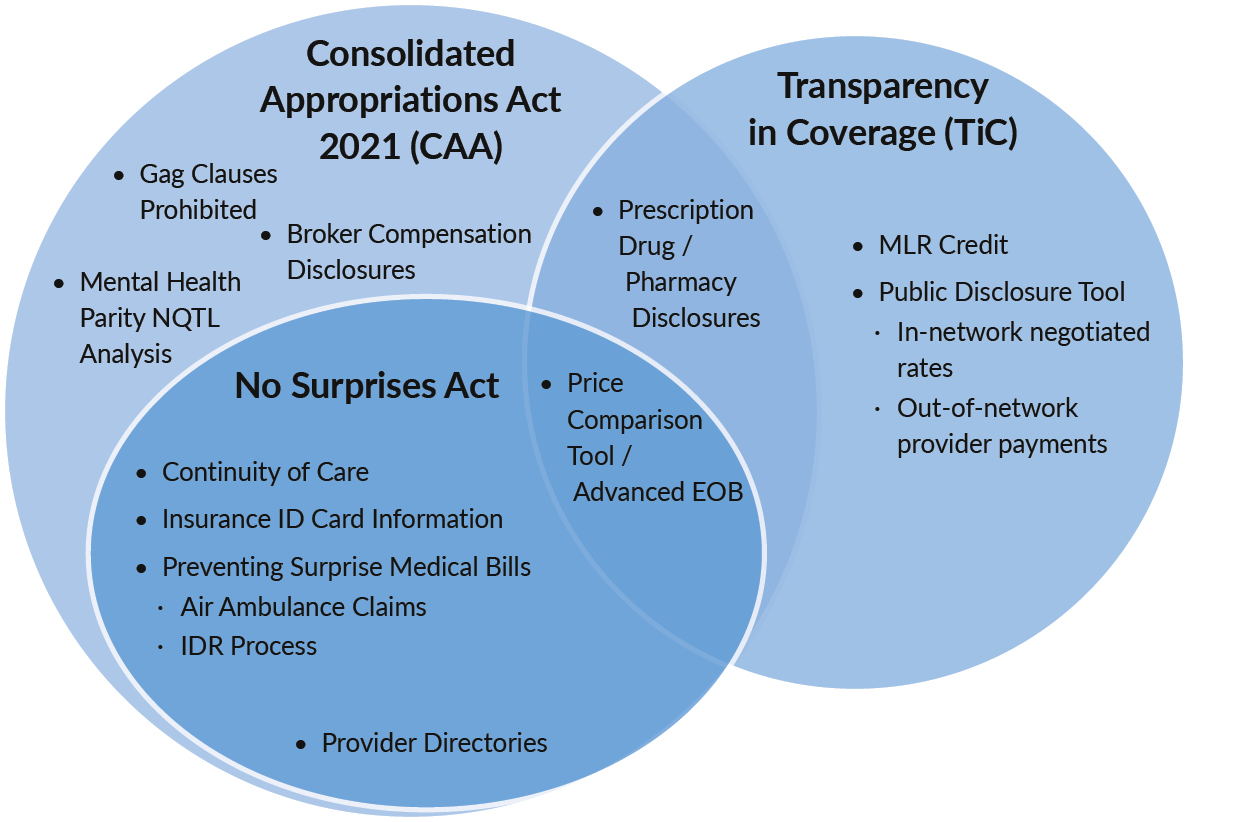

In November of 2021, the Departments of Labor, Health and Human Services, and the Treasury (Departments) released an in interim final rule, "Prescription Drug and Health Care Spending," implementing Section 204.2 Subsequently, the Department of Health and Human Services (HHS) released supporting documents for the regulations, including a review of who must submit and when, data submission instructions, and examples of specific categories of reporting. While insurers, third party administrators (TPAs) and pharmacy benefit managers (PBMs) are expected to provide much of the reporting, group health plans are ultimately responsible for ensuring that the necessary information is submitted on their behalf. The diagram below is a visual overview of how the RxDC reporting fits into the larger scheme of health care transparency legislation ("Prescription Drug / Pharmacy Disclosures").

Venn diagram illustrating prescription drug and health care spending report overlap as part of the Consolidated Appropriations Act, 2021 (CAA) and Transparency in Coverage (TiC) rules. Diagram includes three overlapping circles – the CAA, TiC and The No Surprises Act. Prescription Drug / Pharmacy Disclosures (“RxDC” reporting) lies in the overlap between the CAA and TiC.

Detail

Who Must Report

While the Departments are expressly allowing—and indeed expect—that third parties such as TPAs, Pharmacy Benefit Managers (PBMs) and health insurers will provide much of the reporting, the CAA ultimately places the responsibility for compliance on group health plans. There is no exception to the reporting requirement for small groups, grandfathered, or fully-insured group health plans. The interim final rule addresses the concept of a “reporting entity” by providing an expansive definition that includes essentially any entity submitting the necessary information on behalf of a plan. Plan sponsors should discuss with insurers and/or TPAs to determine who will prepare and submit the necessary reporting for each plan. Agreements should be documented in writing.

Reporting Deadlines

The Centers for Medicare and Medicaid Services (CMS), the agency tasked with gathering the information required by Section 204, refers to these as "RxDC" reports. "Rx" stands for Prescription Drug, and "DC" stands for Data Collection. RxDC reporting is due on June 1 annually for the prior "reference year." A reference year is the calendar year immediately preceding the calendar year in which the RxDC report is due. So, for example, information for 2023 reference years—essentially just a calendar year—is due on June 1, 2024. The deadline applies regardless of a plan's renewal date or plan year. The deadline presents somewhat of a challenge for plan sponsors who change insurers/TPAs or PBMs mid-year, as it will require coordination to ensure that each vendor (or, if not, the plan sponsor themselves) is able to report partial year information.

Information That Must be Included in the Reports

The interim final rule outlines several categories of information that must be submitted, including the following:

- General identifying information such as Federal Employer Identification Number (FEIN), plan year dates, covered lives and each state in which coverage is offered;

- Health care spending by type of cost including hospital costs, primary and specialty care provider and clinical service costs, prescription drugs, and other medical costs;

- Average monthly premium amounts paid by employers on the participants’ behalf, and the average premium paid by participants, beneficiaries and enrollees;

- “Top 50” drug lists, including the top 50 most frequently dispensed drug brands and number of paid claims for each, the top 50 most expensive drugs by total annual spend by the plan for each drug, and the 50 prescription drugs with the greatest increase in plan expenditures over the plan year;

- Prescription drug rebates, fees and any other applicable remuneration paid by drug manufacturers to the plan, issuer, or its administrators or providers, and any impact the rebates, fees and remuneration has on the cost of drugs under the plan; and

- A “Top 25” drug list of prescription drugs generating the highest rebate amounts.

This data must be submitted via the CMS Health Insurance Oversight System (HIOS) through an RxDC module. CMS has provided reporting instructions, including help desk contact information, which can be found at https://www.cms.gov/CCIIO/Programs-and-Initiatives/Other-Insurance-Protections/Prescription-Drug-Data-Collection.

These instructions are periodically updated to provide clarity on frequently asked questions, such as how to calculate average monthly premiums.

What Should Plan Sponsors Do Now?

The Departments have strongly encouraged plan sponsors and insurers to prepare well in advance to comply. For group health plan sponsors, chief among these necessary compliance steps is communicating with relevant vendors about how they will assist with detailed reporting requirements, since few, if any, group health plans will possess the requisite information on their own. The actions plan sponsors will need to take will vary based on their group health plan’s structure, the level of the insurer’s or TPA’s involvement, and other factors, such that a one-size- fits-all checklist is impracticable. That said, there are several steps that plan sponsors can take to prepare.

Fully-insured Plan Sponsors

Plan sponsors will need to confirm who will submit the required data via CMS’s HIOS system through the RxDC module. Fully-insured plan sponsors will generally be able to rely on carriers for this step but should verify whether the carrier will be submitting all or a portion of the data on the sponsor’s behalf. Even where insurers will submit information on a plan's behalf, they will generally need additional information from plan sponsors such as employer versus member premiums. To that end, plan sponsors should be alert to carrier communications requesting any additional information, noting any deadlines imposed by the carrier.

Fully-insured groups can shift liability to the carrier. The regulations state, “if a health insurance issuer and a group health plan sponsor enter into a written agreement under which the issuer agrees to provide the information required... and the issuer fails to do so, then the issuer, but not the plan, violates the reporting requirements...” As to what is sufficient to constitute that written agreement has not yet been clarified. A generic email announcement stating what the carrier is willing to do probably would not, under a conservative reading of the rules, constitute a “written agreement” that would shield the plan sponsor from liability should the carrier fail to report the requisite information. Certainly, a signed written agreement between the plan sponsor and carrier is preferred and encouraged as a best practice; although, practically speaking, a mass communication may be the only assurance many plan sponsors are able to obtain from the carrier. Clarification from the Departments on this point would be welcome.

Self-funded Plan Sponsors

While self-funded plan sponsors can also enter into agreements with vendors to complete these requirements, ultimately, they cannot shift liability for compliance. Therefore, more proactive action is prudent for self-funded plan sponsors.

First, because the necessary reporting information may reside with multiple sources, plan sponsors will need to determine which sources possess the required information. For example, while plan sponsors will typically have information on the average monthly premium paid by the plan and enrollees, the TPA is more likely to have the data related to prescription drug and health care expenditures and impact of rebates. While the insurer will often handle all prescription benefits for a fully-insured plan sponsor, self-funded plan sponsors – particularly those with carved-out prescription benefits – may have to coordinate the reporting process with not only the TPA but also their PBMs or even other vendors. Determining where the information is might be as simple as an email exchange with the relevant vendors, but this is an important step in the data collection process.

Plan sponsors will also have to decide who will perform the reporting. Keep in mind that it is possible for a plan to meet its Section 204 reporting obligation by having multiple entities submit files on its behalf. Many vendors are giving clients the option to request their individual plan data to submit the reporting themselves, or to allow the vendor to perform at least a portion of the reporting on their behalf. And naturally, many plan sponsors will want to allow these third parties to assist in this way. Vendors will have specific deadlines that must be met by plan sponsors and should be carefully noted. It is expected that vendors will charge fees in connection with preparing this information, with the level of fee dependent on the complexity of the pharmacy benefits. One consideration when deciding who should report should be that, while the Departments have encouraged aggregate submissions, multiple entities should not submit the same data for a plan, i.e., avoid “double reporting.” So, in essence, plan sponsors should keep track of who is reporting what.

Plan sponsors should obtain contractual commitments, if possible, from any vendor providing such reporting on the plan’s behalf. As stated above, vendors may be unwilling to enter into a contractual agreement wherein they agree to bear liability for noncompliance.

Because data is filed for a prior reference period, plan sponsors who changed carriers, TPAs or PBMs should always confirm with the prior service provider to verify the assistance they will provide with the required reporting – whether by filing on behalf of the former client or by providing necessary information to the former client to report for themselves.

Finally, plan sponsors should remain alert to the possibility of future guidance or clarification to the existing rules.

Penalties

While the regulations do not outline any specific penalty for failure to comply, there is the possibility that regulators could levy an IRS excise tax penalty of $100 per day per affected individual. The Department of Labor can also enforce compliance for ERISA plans, while the Department of Health and Human Services can enforce compliance on non-ERISA plans.

Conclusion

While the CAA’s prescription drug and health care reporting requirements ultimately place responsibility for compliance on group health plans, plan sponsors will need to lean heavily on carriers and TPAs in order to provide the necessary reporting. Because the data may be submitted by a variety of entities and the Departments have said their expectation is that many insurers, TPAs and PBMs will submit for the plans, sponsors should contact and negotiate with carrier and TPA partners to provide the necessary information. Group health plan sponsors should familiarize themselves with the law and existing guidance and work with vendors to ensure proper coordination of efforts.

Authored by Stephanie Raborn, JD

National Specialty Practices | Employee Benefit Solutions

References

- 1 - Section 204 of Division BB of the CAA, found at https://www.congress.gov/116/plaws/publ260/PLAW-116publ260.pdf

- 2 - Prescription Drug and Health Care Spending; https://www.govinfo.gov/content/pkg/FR-2021-11-23/pdf/2021-25183.pdf

Insurance products and services offered through McGriff Insurance Services, LLC, a subsidiary of Truist Insurance Holdings, LLC, are not a deposit, not FDIC insured, not guaranteed by a bank, not insured by any federal government agency and may go down in value.

McGriff Insurance Services, LLC. CA License #0C64544